Single Touch Payroll Update

Single Touch Payroll (STP) was introduced on 1st July 2018 for all businesses with 20 or more staff.

The Bill to extend STP reporting requirements so they apply to ALL employers, regardless of the number of employees, has now passed the Senate and will be Law.

This means STP will be rolled out to smaller businesses with less than 20 employees from 1 July 2019.

You need to be aware of the STP requirements and how they affect you.

What is STP?

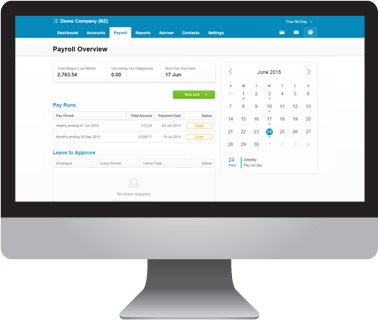

STP requires you to electronically send payroll data to the tax office EACH time your employees are paid via STP compliant software.

To be compliant, you need to report the following each pay run:

- Employee’s name and tax file number

- Gross amount paid

- Tax withheld, and

- Super guarantee obligations

Once you are on STP, the tax office will then tell you the amount of PAYG tax withheld to pay on your activity statements. The tax office will also provide information regarding your super contributions payable each quarter. Employees will be able to access real time information about their wages and super.

If you are already using payroll software, you will need to confirm that it is STP compliant. If you are still using a manual payroll system (eg spreadsheets, ATO paper tax tables and post-it notes), you will need to take action now to ensure you are compliant before 1 July 2019.

You can opt in to STP now and not wait until the 1 July 2019 deadline. Please contact us with any questions or if you want your system reviewed. There are low cost solutions available for small businesses. The time is here to embrace cloud-based solutions that save time and simplify your life.